TIME TO SHINE.

Superior Silver

Silver is a secret investment weapon that is often overlooked.

While having all the advantages of gold, you can acquire silver for a fraction of the cost. Due to its industrial status, it has a higher growth potential making it desirable for both preservation of capital and profit. This undervalued precious metal is high in demand because of global consumption causing silver to be less available than gold.

Silver is a great alternative to traditional investments; providing liquidity, protection against inflation, diversity and security. It is time to let your portfolio shine with some silver.

The Silver Lining

Supply & Demand

Surprisingly, less silver is available than gold. While gold is more rare below ground, there are far fewer ounces of silver available above the ground. Silver is getting used up faster than it is being mined. New deposits are not being located and surplus continues to decrease to meet demand. Silver is used in industries at a greater rate than any other precious metal. More than half of the demand for silver is used for industrial purposes, and of that amount 30% is thrown away.

It is hard to imagine we throw away a precious metal that is necessary for everyday use. Of all chemical elements, silver has the most powerful antibacterial properties with the least toxicity thus increasing its use in the medical industry. Silver takes the lead in electrical and thermal conductivity. It has sensitivity to light and is the most reflective of all the metals. As technology advances so does the need for silver. It seems inevitable that these factors among many others will drive up the price of silver.

Truth & Trends

For over 2,500 years silver has been used to store wealth. It was the foundation of most monetary systems before the 20th century. Not long ago currencies were backed by silver. In fact, if you take a look at a pre 1971 dollar bill you will see it was printed as a ‘silver certificate’ that could be exchanged for physical silver. Today currency is printed as ‘federal notes’ backed by nothing, thus having no accountability to the expansion of supply. More currency has been printed (or expanded by digital means) in the last couple of years than the previous 100 years combined. This is where inflation comes from. If you expand the currency supply, prices will rise. We see this today when purchasing basic goods and services such as groceries.

For much of history, it took roughly 16 ounces of silver to buy 1 ounce of gold. Recently, it takes 60 ounces of silver to buy 1 ounce of gold. This ratio change indicates that prices are likely artificially influenced. Whatever the cause, eventually the ratio will balance itself, as it always does. Once this happens, history has shown that gold and silver will meet or exceed the value of all currency in circulation.

Time to Shine

The idea of silver being an investment is a modern understanding. Typically, this metal was thought only to be of industrial use; even though for thousands of years it has been used as money. Many factors contribute to the investment qualities of silver. History shows that in a bull market silver will make more dramatic gains. Silver increased 3,105% from 1970 to 1980 while gold increased 2,328%.

A more recent example would be from 2008 to 2011. Silver increased by 448% while gold increased by 166%. The opposite is true for silver and gold in bear markets where silver will experience more dramatic lows. Every investment comes with risk. Although silver hedges inflation and has great potential for increase, it has higher premiums and greater volatility. Even with this knowledge, precious metal buyers tend to overweigh their purchases heavily into silver.

Spot Price

Spot price is the acknowledged base line for the market pricing of precious metals. This price constantly changes and does not factor in the actual costs associated with acquiring the metal in physical form. When gold is purchased the premium above spot price will reflect the process to mine, melt, mint, insure and ship the metal to the consumer.

Precious metals are sold for spot price which means these costs are not recuperated unless the spot price has exceeded the price paid for metal. This is important to know when acquiring physical precious metals. Spot prices are typically represented in USD however, PGS converts pricing to CAD for our Canadian clients. Bringing gold into your portfolio should be considered for mid to long term holdings to mitigate risk and capture investment potential.

Silver Top Picks

We have access to hundreds of silver products. Availability is determined by supply and demand. Our Top Silver Picks highlight some of our favorite and most popular items. Silver coins and bars are popular investments and collectors’ items. Silver coins have been used as real currency for thousands of years.

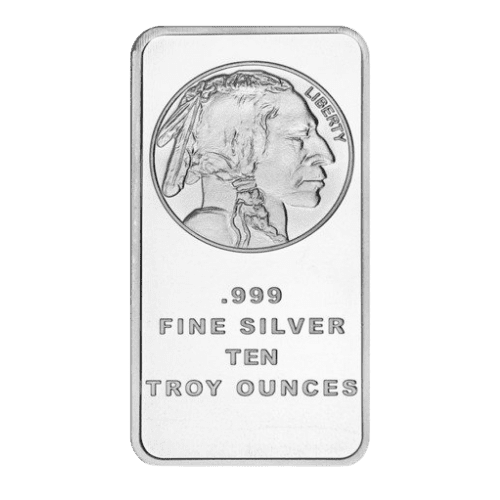

Silvertowne Buffalo Silver Bar

From humble beginnings in 1949 as a small coin shop in rural Indiana, SilverTowne has become one of the largest and most trusted silver, gold, and numismatics dealers in the United States.

From a cigar box under a lunch counter to a multi-million dollar business, SilverTowne has grown from a small coin shop to two retail departments under one roof. The SilverTowne Mint has become well known for producing high quality, affordable, bullion products with exceptional purity standards. Ten ounce bars are extremely popular and a great way to diversify your portfolio.

Silvertowne Eagle Silver Bar

From humble beginnings in 1949 as a small coin shop in rural Indiana, SilverTowne has become one of the largest and most trusted silver, gold, and numismatics dealers in the United States.

A patriotic design featuring an eagle with wings expanded.With fine detail on the eagle’s wing feathers down to the talons ready to grasp the branch, this design is on a proof-like background. The SilverTowne Mint has become well known for producing high quality, affordable, bullion products with exceptional purity standards. Ten ounce bars are extremely popular and a great way to diversify your portfolio.

Silvertowne Buffalo Silver Round

Indian Head / Buffalo 1oz Pure Silver Replica Round are modeled after the Buffalo Nickels (Indian Head Nickels) which were minted by U.S. mints from 1913 through 1938 in copper-nickel composition and designed by James Earle Fraser. With the wild popularity of buffalo nickels, SilverTowne has minted Buffalo Replicas annually for over a decade. The SilverTowne is private mint and is not stamped with a dollar value, rather replaced with the weight and purity designation of “1oz 999 FINE SILVER”.

Sunshine Mint Silver Round

Sunshine Minting Inc. (SMI) is a leading domestic and global supplier of precious metal and base metal mint products. Sunshine Mints customers are governments, financial institutions, corporations, major marketing companies, other businesses, and private groups. SMI supplies high quality precious metal blanks to Government and Private Mints around the world. As the most recognized private mint in North America for the production of bullion bars and rounds, weight and purity is guaranteed and make an excellent addition to a precious metals portfolio.

Royal Canadian Mint Silver Bar

With a rich history, dating back to 1908, the Royal Canadian Mint is recognized as one of the largest and most versatile mints in the world, offering a wide range of specialized, high-quality coinage products and related services on an international scale.

The Royal Canadian Mint is renowned for producing some of the highest quality and purity of gold and silver bullion coins and bars in the world. Their high standards for excellence and quality allowed them to be the first refinery to manufacture 9999 fine gold bullion coins in 1982, as well as the first to reach 99999 fine gold purity in 1999.

Canadian Maple Leaf Silver Coin

The Royal Canadian Mint stands for excellence in bullion production worldwide. At the heart of their distinctive line of bullion products is their collection of signature gold and silver Maple Leaf coins, instantly recognized by their iconic design and unsurpassed purity. From facilities in Ottawa, Ontario and Winnipeg, Manitoba, RCM produces coins for Canadian trade and commerce, manages the country’s coin system for optimum efficiency and cost, and is a world-renowned manufacturer of precious metals investment products, collectibles and medals.

As a Crown corporation they are owned solely by the Government of Canada, and mandated by the Royal Canadian Mint Act to mint coins in anticipation of profit and to carry out other related activities.