TIMELESS VALUE.

Good ol’ Gold

The advantages are unlike any other investment:

- Thousands of years has shown gold maintains purchasing power

- Shields you from loss by acting as a hedge against inflation

- Can be sold for cash or traded for goods

- Is portable, easy to store

- Is a private and confidential form of wealth

There is a reason why some of the Globes largest institutions, banks and private investors own and hold physical gold. Wisdom shows in times of uncertainty and crisis, diversifying into this monetary metal is “as good as gold.” Owning physical gold is one of the best strategies for long term wealth preservation.

Stack The Facts!

Timeless Value

Throughout history, no paper currency has survived the test of time like gold. The average lifespan of a currency is about 35 years. Eventually, all paper currencies become worthless. The reason this happens is because paper money (fiat currency) is not backed by anything and therefore has no limit on how much can be printed or digitally produced. Through extreme global currency surplus, we can see the death of our purchasing power – also known as inflation. The US dollar for example has declined by 98% since 1913! This is why it takes a much higher stack of cash to pay for goods and services today than 100 years ago. Those items are not more valuable, it is our currency that has depleted and continues to do so year after year.

Gold maintains purchasing power and hedges inflation creating timeless value. This reason is the driving force behind why people acquire physical gold into their portfolio.

Real Money

Although gold is not used as currency today, possession of this precious metal is superior to any currency for various reasons. Physical gold is real money and is not subject to the risks that occur with paper or digital currency. Gold will always have value because it is the only financial asset that is free from liability. This means it can not go bankrupt or default to zero.

At all times gold has represented real wealth and acted as a medium of exchange. There is a 3000 year track record to back it’s ‘real money’ status. One of the main reasons for its success is due to the fact that man can not create or print gold. The value of gold comes from the natural limits on its supply. Gold can be used to purchase nearly any good or service globally and is easily liquidated for cash when needed. Gold is the ultimate protection against economic uncertainty, vulnerability in the stock market, political overreach and offers liquidity, portability and confidentiality.

Spot Price

Spot price is the acknowledged base line for the market pricing of precious metals. This price constantly changes and does not factor in the actual costs associated with acquiring the metal in physical form. When gold is purchased the premium above spot price will reflect the process to mine, melt, mint, insure and ship the metal to the consumer.

Precious metals are sold for spot price which means these costs are not recuperated unless the spot price has exceeded the price paid for metal. This is important to know when acquiring physical precious metals. Spot prices are typically represented in USD however, PGS converts pricing to CAD for our Canadian clients. Bringing gold into your portfolio should be considered for mid to long term holdings to mitigate risk and capture investment potential.

Gold Top Picks

We have access to hundreds of gold products. Availability is determined by supply and demand. Our Top Gold Picks highlight some of our favorite and most popular items. The quality, purity and beauty of our products can compliment any portfolio. Leading the industry in refining, the companies behind these mints are universal symbols of innovation, ingenuity, and excellence.

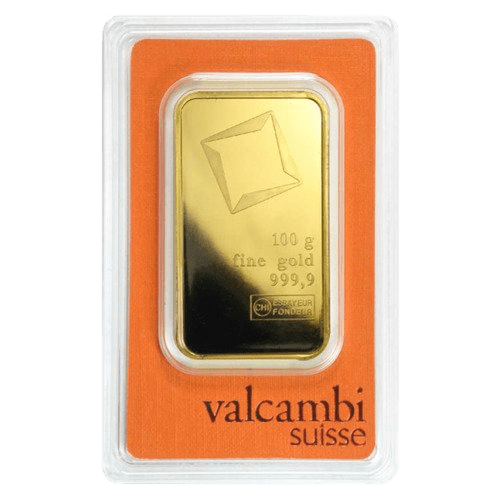

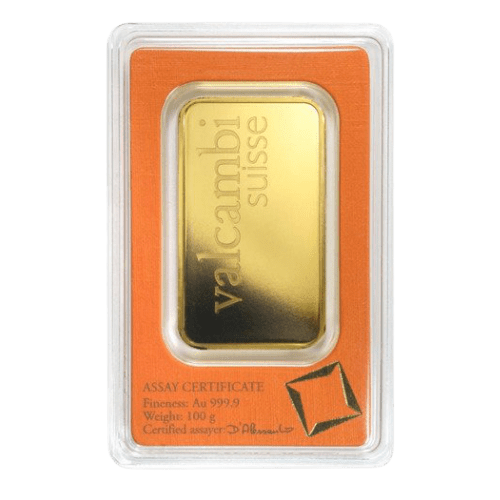

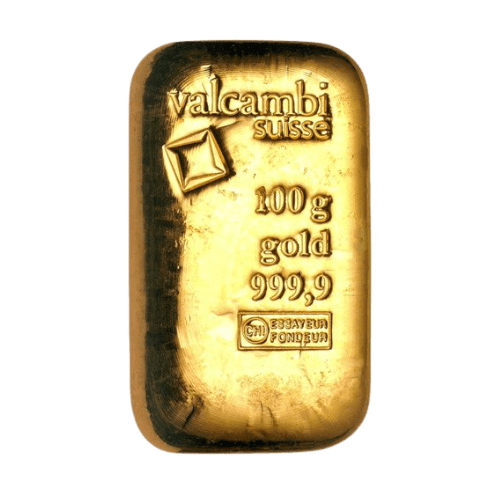

Valcambi Suisse Gold Bars

Each bar consists of 9999 fine gold and comes in a variety of sizes from 1 gram to 1 ounce.

Throughout its 60 year history Valcambi has focused solely on the business of precious metals refining. As a boutique refinery, Valcambi draws on the best practices in technology and manufacturing to meet clients’ needs and objectives.

Valcambi is a private precious metals refiner, located in Switzerland, admired for its state-of-the-art process and extraordinary high-quality product. Valcambi holds the reputation as the largest gold refiner in the world with a precious metal refining capacity of over 2400 tons per year!

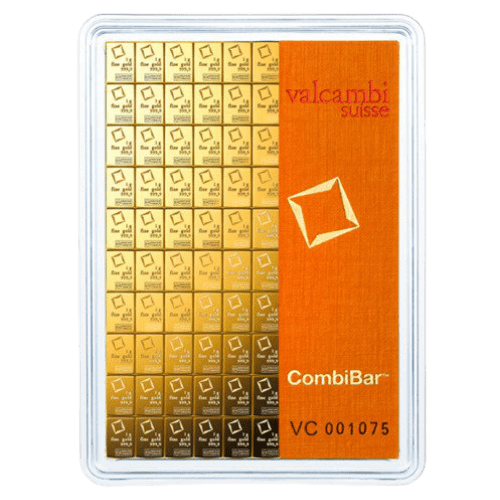

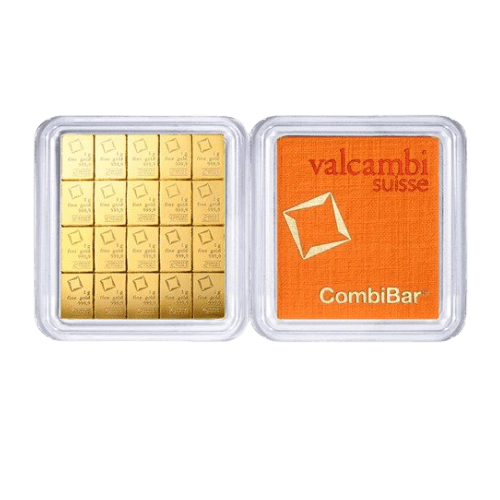

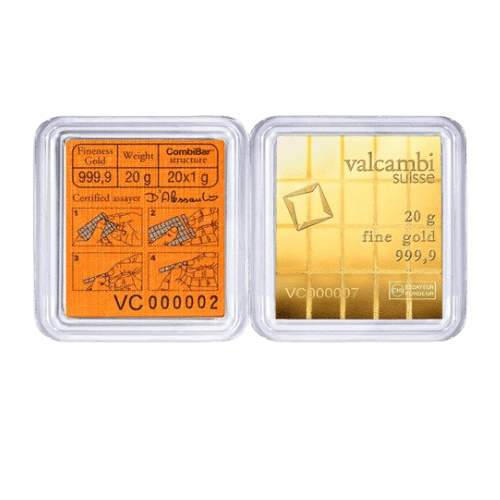

Valcambi Suisse Gold CombiBar

CombiBars are unique as each gram can be seamlessly separated from the bar. This feature provides diversification and practical use all in one convenient bar. These revolutionary bars are available in 20, 50 and 100 gram bars which can each be broken down into individual one-gram gold bars.

Valcambi is a private precious metals refiner, located in Switzerland, admired for its state-of-the-art process and extraordinary high-quality product. Valcambi holds the reputation as the largest gold refiner in the world with a precious metal refining capacity of over 2400 tons per year!

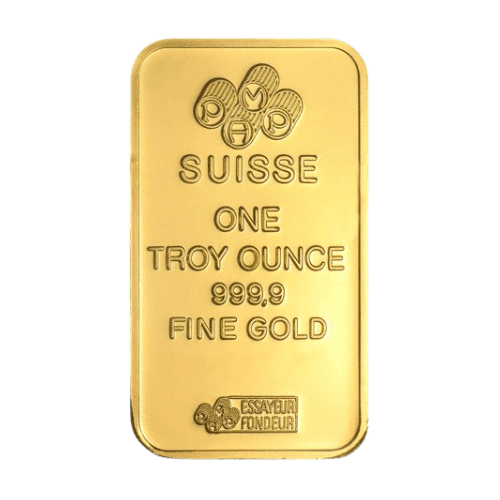

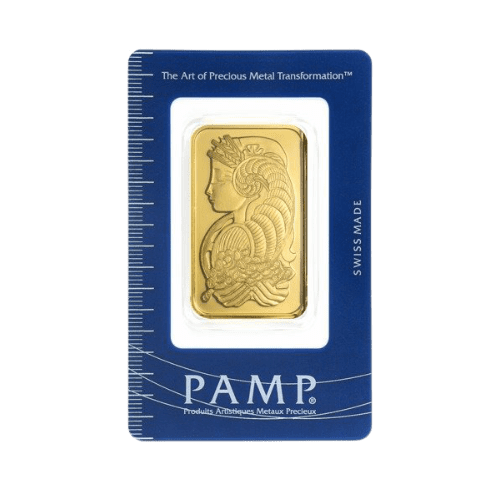

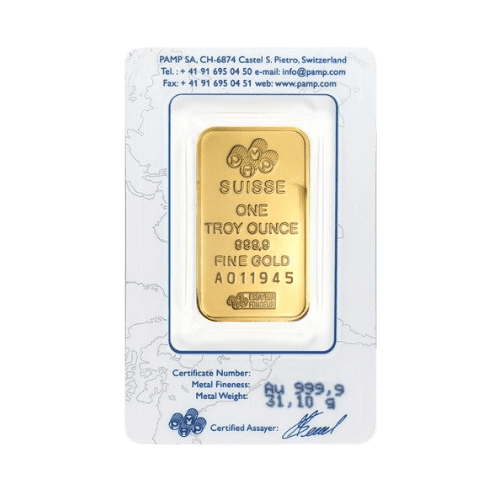

PAMP Suisse Gold Bar

Since its inception, the PAMP brand was quickly established as an industry leader with transparency and sustainability integrated into its business strategy and throughout all endeavors. Established in 1977 and based in Ticino, Switzerland, PAMP rapidly became the world’s leading bullion brand, with dominant positions in the world’s major precious metals markets.

PAMP was the first precious metals brand to ever decorate the reverse sides of its minted bars. Introduced in 1979, the Lady Fortuna™ was the original of those artistic motifs and is today world-renowned as a trusted symbol assuring PAMP quality excellence and authenticity. With a distinctive proof-like finish, the Roman goddess of prosperity is portrayed with all her mythical attributes: Sheaves of wheat, poppies, horn of plenty, precious coins, and wheel of fortune. Undoubtedly, the iconic Lady Fortuna™ image is the most recognized and prestigious bullion bar design in the world.

Accredited by the Swiss Federal Bureau, each bar is individually registered and sealed within protective CertiPAMP™ packaging with an integrated and official Assay Certificate that guarantees fine precious metal content and weight, protected with a removable film.

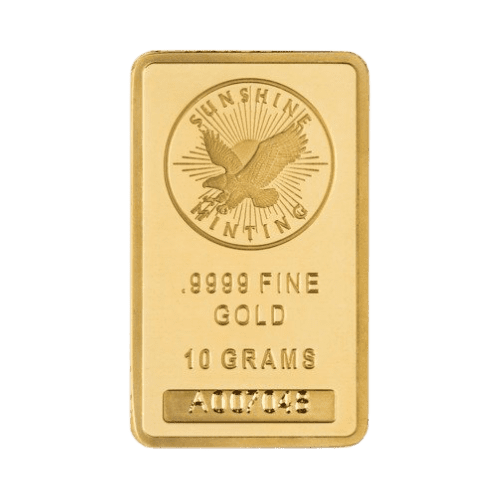

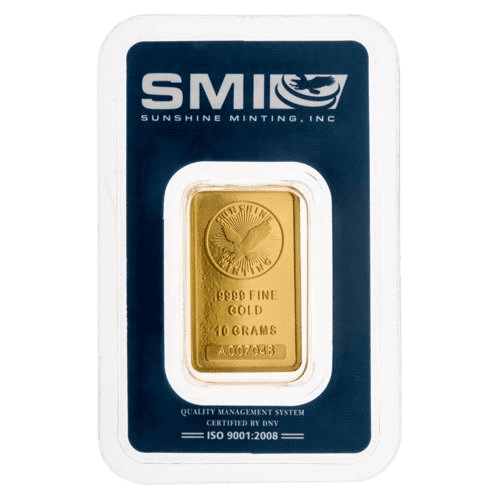

Sunshine Mint Gold Bar

Sunshine Minting Inc. (SMI) is a leading domestic and global supplier of precious metal and base metal mint products. Sunshine Mints customers are governments, financial institutions, corporations, major marketing companies, other businesses, and private groups. SMI supplies high quality precious metal blanks to Government and Private Mints around the world. They specialize in fine gold blanks. Sunshine products are an excellent addition to a precious metals portfolio.

Royal Canadian Mint Gold Bar

With a rich history, dating back to 1908, the Royal Canadian Mint is recognized as one of the largest and most versatile mints in the world, offering a wide range of specialized, high-quality coinage products and related services on an international scale.

The Royal Canadian Mint is renowned for producing some of the highest quality and purity of gold and silver bullion coins and bars in the world. Their high standards for excellence and quality allowed them to be the first refinery to manufacture 9999 fine gold bullion coins in 1982, as well as the first to reach 99999 fine gold purity in 1999.

Canadian Maple Leaf Gold Coin

The Royal Canadian Mint stands for excellence in bullion production worldwide. At the heart of their distinctive line of bullion products is their collection of signature gold and silver Maple Leaf coins, instantly recognized by their iconic design and unsurpassed purity. From facilities in Ottawa, Ontario and Winnipeg, Manitoba, RCM produces coins for Canadian trade and commerce, manages the country’s coin system for optimum efficiency and cost, and is a world-renowned manufacturer of precious metals investment products, collectibles and medals.

As a Crown corporation they are owned solely by the Government of Canada, and mandated by the Royal Canadian Mint Act to mint coins in anticipation of profit and to carry out other related activities.